Licensing a vehicle for use

In order to be able to drive a vehicle, it must be licensed for use. This means that you as the owner must have traffic insurance and pay vehicle tax for your vehicle. If you want to start using a vehicle that is subject to an off road notification, it must always be licensed for use.

The vehicle may be driven as of the date on which it was licensed for use. Bear in mind that you cannot request licensing for use retroactively; licensing applies from and including the date on which we register your application. This is normally the date on which the application has been received by us or a date in the future that has been specified in your application.

How to license a vehicle for use

You can apply for a licence for use in three different ways:

- online via our service (in Swedish only),

- in writing on your registration certificate.

Please note that you cannot apply to license a vehicle for use by calling Customer Services.

Applying online

This service is available in swedish only.

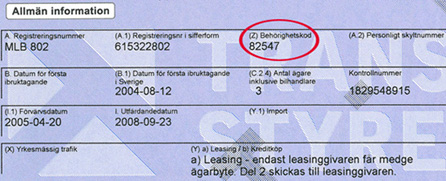

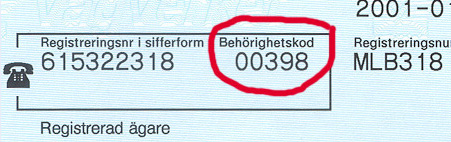

The first step is to log onto the service. You can do this using the registration number and authorisation code (Behörighetskod) or using e-identity. You will find the registration number and authorisation code on your registration certificate.

What is an authorisation code?

The appearance of the registration certificate varies depending on whether you have a new or an old document.

More information about registration certificates.

The vehicle must have traffic insurance

In order to license your vehicle for use, you must be registered for traffic insurance in the Swedish Road Traffic Registry (this does not apply to trailers). If the vehicle has been previously licensed for use, we usually have information about dormant insurance. If so, we will activate this insurance and notify your insurance company when you license the vehicle for use. If you do not have traffic insurance, you must contact your insurance company and take out insurance before applying to licence your vehicle for use.

Vehicle tax and charges

You must pay vehicle tax in conjunction with your vehicle being licensed for use. We will immediately send you a remittance slip. The tax must be paid no later than three weeks from the date on which the vehicle was licensed for use. In some cases, a road traffic registry fee is charged together with the tax.

Impediments to using the vehicle

In some cases, a vehicle may not be driven despite being licensed for use. This applies if there is a driving ban because of a failure to undergo a roadworthiness test or a ban on use owing to unpaid vehicle tax.

You will receive information about a driving ban because of a failure to undergo a roadworthiness test or a ban on use owing to unpaid vehicle tax if you apply for a licence for use via the Internet. But it is up to you, as the owner of the vehicle, to know if you are allowed to drive the vehicle or not.

The Swedish Tax Agency makes tax decisions

The Swedish Transport Agency determines tax obligations by means of automatic data processing. Do you consider that you have been incorrectly charged with vehicle tax and would like to have the tax refunded? If so, you must refer to the Swedish Tax Agency in order to have your matter considered. The Swedish Tax Agency makes decisions regarding tax obligations.